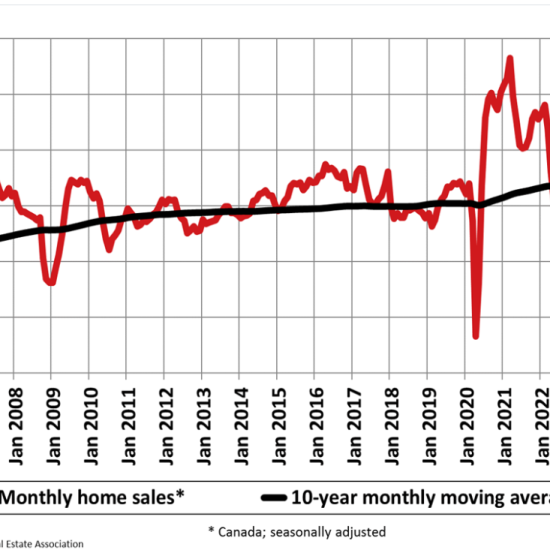

In January 2025, Ontario’s real estate market saw a decline in home sales but an increase in new listings and active listings, indicating a shift toward a more balanced market. The average home price in Ontario reached $834,050

Ontario’s Real Estate Outlook for 2025

The Ontario housing market is shifting with growing inventory and fluctuating mortgage rates.

- Is it becoming a buyer’s market? More inventory means less competition for buyers, potentially softening home prices.

- How will mortgage rates impact the market? Higher rates have kept some buyers out, but a potential rate drop in 2025 could increase demand.

- Is now the right time to invest? Investors and move-up buyers may find better deals with more listings and stabilizing prices.

What This Means for Buyers & Homeowners

Buyers now have more choices and less competition, giving them more substantial negotiating power than in previous years. While home prices have remained stable, the growing inventory may push sellers to adjust their pricing strategies. For those considering purchasing or refinancing, securing a favourable mortgage rate is crucial in today’s shifting market.

Whether opting for a fixed or variable mortgage, understanding current trends in Canadian mortgage rates can help homeowners and investors make the best financial decisions.

Source: Nesto.ca